When it comes to online trading , the first goals to consider are the financial goals you want to achieve and the investment risks you are willing to take. Once the goals to be reached have been defined, the training phase is important : it will therefore be necessary to study this area through books, training courses and sector events http://abouttrading.pt

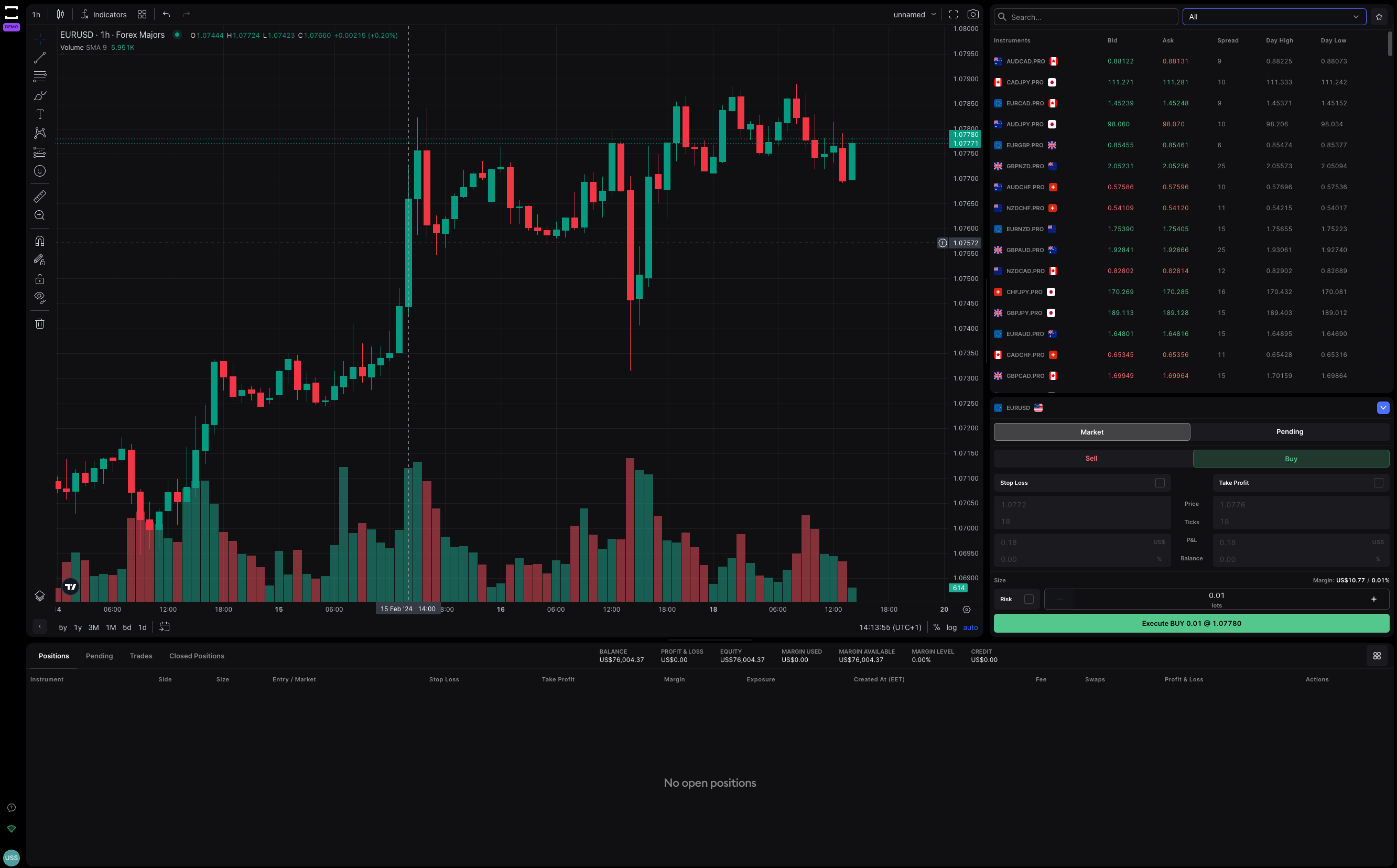

Once the basics for setting up an online trading strategy have been defined , it is possible to consider what are the main strengths of this online financial investment methodology. The first element concerns the commissions , which, in online trading, are reduced to the minimum terms, almost equal to zero. In fact, the real earnings of online brokers are linked to the spread rather than commissions. The platforms for this type of online financial investment are very simple to use , and offer all the tools for technical analysis and position management.

Another advantage of online trading is the ability to monitor investments made in real time . With this strategy, you can independently monitor your financial portfolio, and monitor the situation of the financial instruments on which you have chosen to invest your savings in real time, thanks to the panel provided free of charge by online brokers. Finally, online trading allows a wide diversification of one ‘s investment portfolio , offering the possibility to choose from a wide range of financial markets.

The advantages of online trading over traditional trading are represented by the lower cost that commissions generally have, as well as the opportunity to get information directly and completely, through the display of graphs and data, on the performance of the securities and, therefore, to carry out more weighted investments. In few countries trading was introduced in 1999, following its regulation and implementing the Consolidated Law on financial markets.

But how do you trade? A first “classic” approach is to buy the title and resell it when it increases in value. For example, you buy Apple’s stock hoping that the stock will go up. To do this, just open an account with a traditional bank. In this way, you become a shareholder of that company listed on the stock exchange and share the fate both in the negative and in the positive. And this is a huge disadvantage or if the stock goes down or collapses you have lost all your money (classic example of the drawer).

Online trading today is done with derivatives by taking advantage of small market fluctuations. The most widely used financial derivatives are contracts for difference (CFDs) and binary options for very short-term transactions.

Don’t be scared. Derivatives are not evil and do not have a negative meaning as many televisions and newspapers want to pass. A derivative is a financial instrument built on a financial asset called an underlying.