Have you ever heard the saying “practice what you preach”? Well, it’s true for traders as well as anyone else. If you’re trading frequently, practicing your strategies and investing a lot of money, you need to get it right the first time. Otherwise, you may find yourself making the same mistakes over and over again. The same applies to trading cryptocurrencies like Bitcoin or Ethereum. You need to get it perfect the first time or risk losing every single trade. This article is going to focus on some of the top secrets of successful cryptocurrency traders to help improve your own trading skills and make sure that you never make the same mistakes again. Keep reading to discover how you can start profiting from the volatile market today!

Look Beyond the Numbers

You might have seen videos and articles about how to spot a bubble or how to trade against the trend, but how exactly do you spot a bubble? And what is a trend? Most people these days think that a true market decline can be detected by spotting a “trend” in the market. This is not the case, according to Bregman. According to a forex broker in Brazil, a trend can be anything from a small change in price to a dramatic one like the decline experienced in the 2008 financial crisis. If you want to spot a trend, you need to look beyond the numbers and analyze the market flow. For instance, if you notice that markets are rising and then fall quickly, it might be a good indication that the trend is towards higher prices. In this case, you should look for entry, stop, and exit points near or at the rise or fall of the trend.

Be Proactive, Not Reactive

When you start trading, you need to be proactive. That is, you should not just react to market opportunities but look for potential trends and trade in advance. For instance, if you notice that markets are rising and think that this is a good omen for your trading strategy, you could sell in anticipation of a rise and buy back in when markets are at their peak. This is a proactive strategy and one that will help you make money in the long run. On the other hand, if you buy when markets are low and then sell quickly when markets rise, you will lose money. Here’s a fair warning from a legitimate forex broker in Brazil: This is a reactive trading strategy and one that will cost you plenty in the long run.

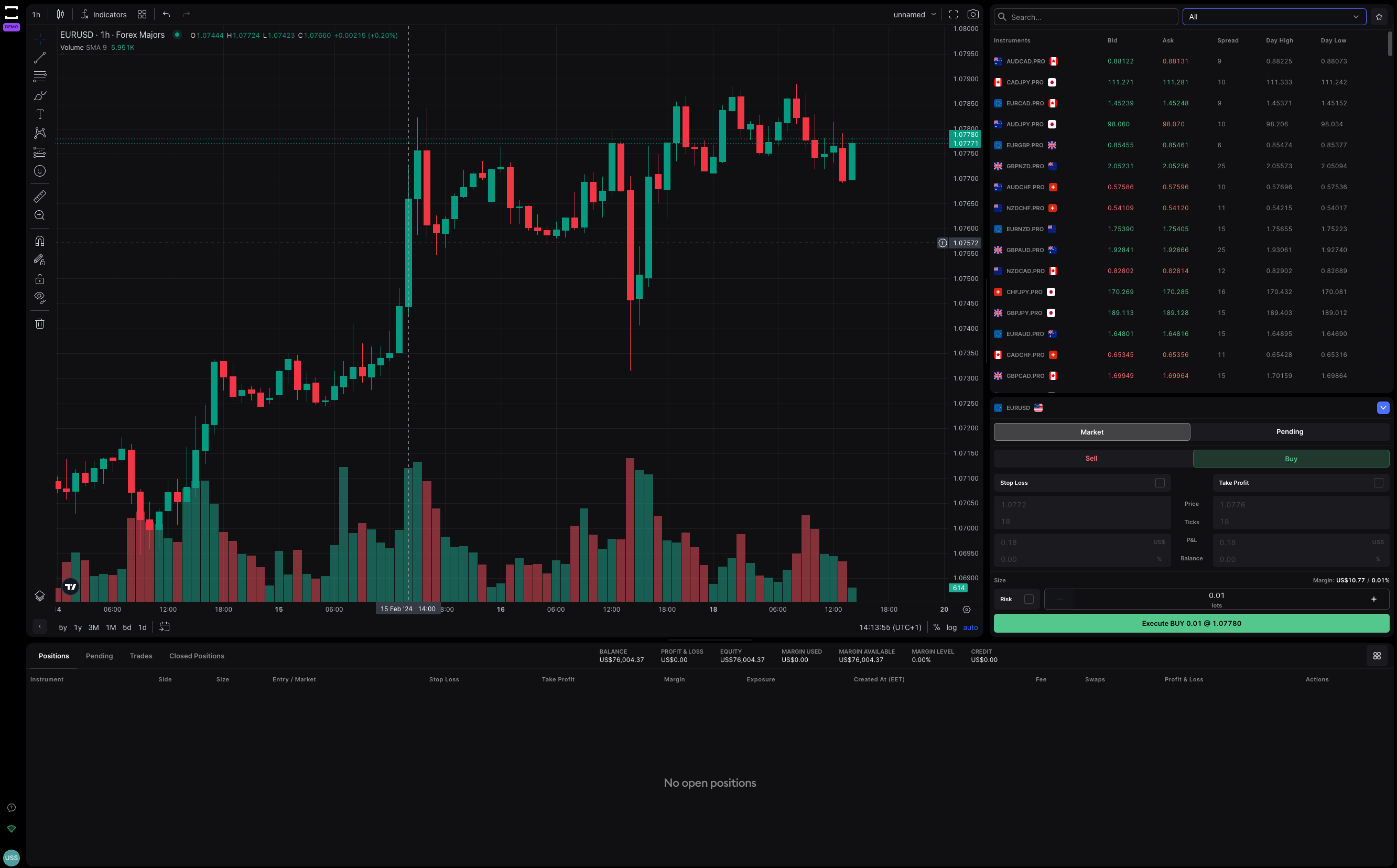

Focus on Stoploss and Dips List Trading

One of the most important aspects of any trading strategy is the stoploss and the dips list. These are indicators that let you know when to close your trade and exit the market. You can also refer to them as “exit points” or “sell orders”. There are many different types of stoploss and dips lists, but the most common ones are: overdone – The price is so high that it causes too many sell orders to be placed at the same time. This is a very bad idea because it will cause the market to overshoot the top and then start falling.

Be Aware of momentum and Chaotic Markets

When you’re just starting out as a trader, you may think that you can control everything about your trading strategy. That is not the case. For instance, when you’re just starting out, you might not be aware of the “psychedelic” nature of the market. This is how markets go when they are just starting out. They are very unpredictable and can move in very different directions at the same time. In this case, it’s best to stay out of the way of the waves since you don’t know where they will next go. Instead, you can look for entry points and stoploss points near the top and bottom of the waves.