A personal loan is an adaptable source of financing. You can get personal loans from banks, online moneylenders, just like here at https://webmoneyloans.com/ or credit associations. What’s more, when you’ve been endorsed for a loan, you can utilize the cash you get for any reason you need. Regardless of whether you’re keen on acquiring from a bank, credit association or an online loan specialist, the procedure is mostly the equivalent. Be that as it may, getting a loan the savvy way requires some additional examination and care to ensure you get the best offer accessible.

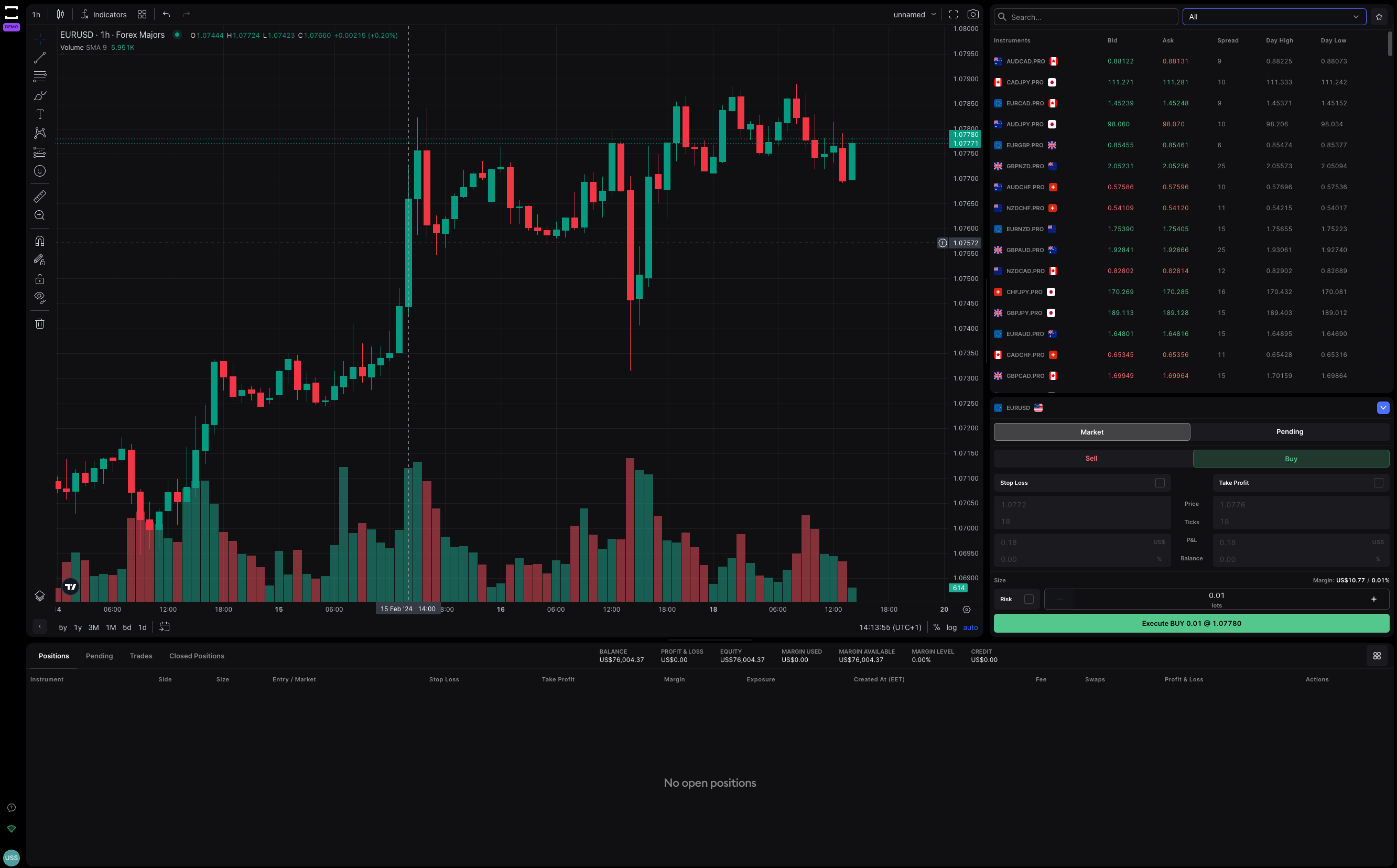

It’s a smart thought to run loan figures before getting a loan. This allows you to perceive the amount you’ll pay for the loan, and how a different loan sum (or financing cost) may set aside your cash. There are a lot of online apparatuses out there to enable you to ascertain loans. It’s additionally astute to see an amortization table with the goal that you can perceive how the loan will get satisfied after some time.

Pre-qualify and Compare Offers

Pre-qualifying gives you a see of the rates, installments, and terms you may get for a personal loan. The pre-qualification process typically includes a delicate credit check, which doesn’t influence your credit score. It’s ideal to pre-qualify with different loan specialists and think about offers. Most online loan specialists and a few banks offer pre-qualification, which you can do on your work area or cell phone and take around five minutes for each moneylender to finish.

Check Your Credit Score

A higher credit score will make it simple for you to get a loan. If your credit score isn’t sufficient, at that point find a way to build it before applying for a loan. You can get a loan with a low credit score yet at a higher financing cost. Most of the best personal loans necessitate that you have at any rate reasonable credit, yet great and brilliant credit will give you the most obvious opportunity with regards to getting affirmed with a decent financing cost. To discover where you stand, check your credit score for nothing on Bankrate.

Give Necessary Documentation

Contingent upon the bank and your credit circumstance, you may need to give some documentation after you present your application. For instance, you may need to transfer or fax a duplicate of your most recent compensation stub, a duplicate of your driver’s permit or evidence of home. The loan specialist will fill you in regarding whether it needs any documentation from you and how to get it to the correct individual.

Get a loan that you can really deal with—one that you can easily reimburse and that won’t keep you from accomplishing other significant things. Make sense of the amount of your salary will go towards loan reimbursement—moneylenders call this an obligation to pay proportion—and get less if you don’t care for what you see. Loan specialists regularly need to see a proportion underneath 30% or something like that. You probably won’t get affirmed on your first attempt. Loan specialists can deny applications for almost any explanation, yet they ought to have the option to reveal to you why you weren’t endorsed. Much of the time, they don’t trust you have adequate pay or credit history to justify the loan you’ve applied for.