The market’s volatility makes it more exciting for traders, but this may be a trap if greed takes over. Trading mistakes are very common but is it possible to avoid or at least minimize these mistakes from happening. Here are some of the common mistakes every trader should avoid:

1. Not having a Trading Plan: One of the most critical tasks before you begin trading is to have a trading plan. Before you trade, you must be able to answer a few questions.

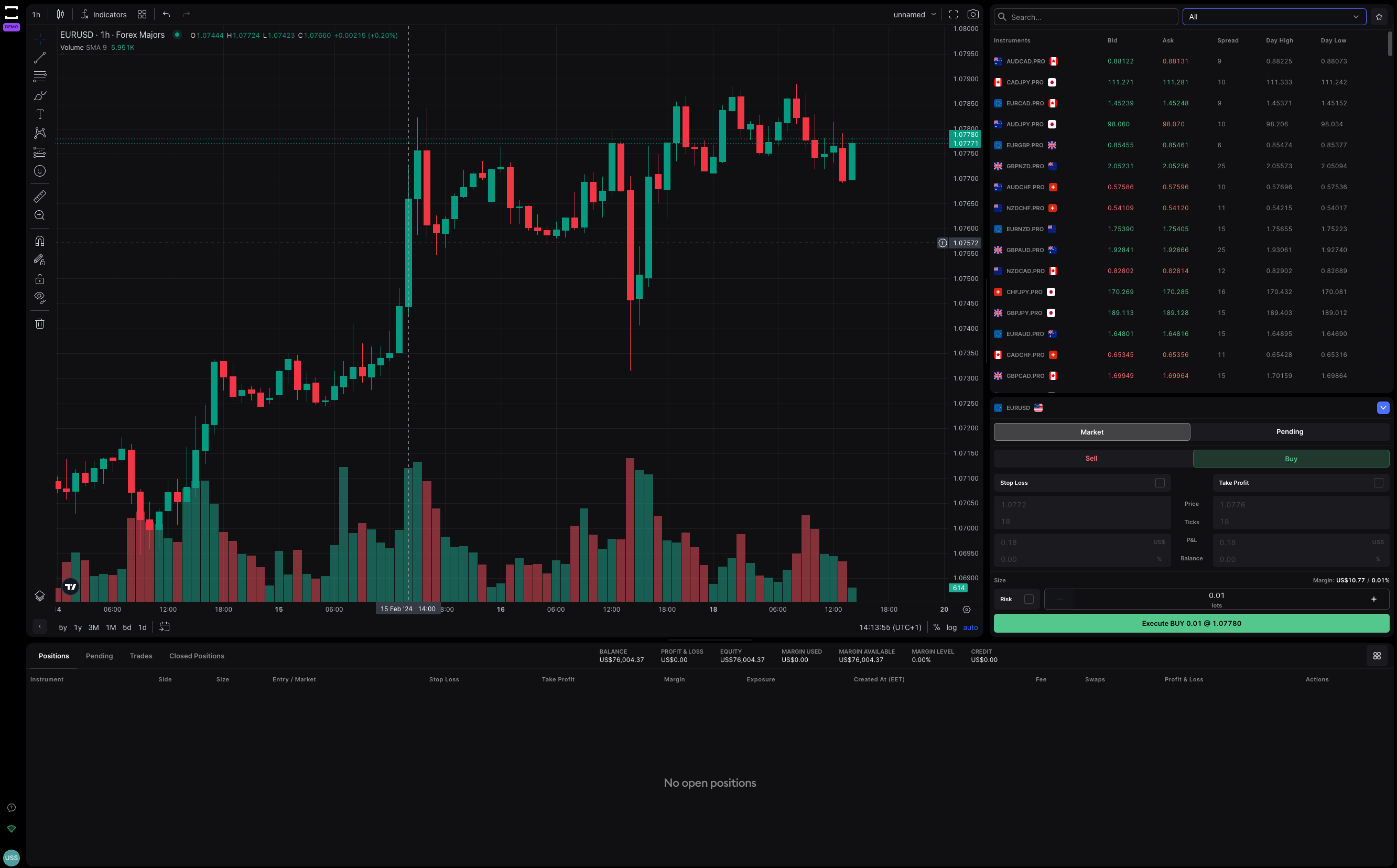

a. What is the price point I’m aiming for?

It is best to set a price point when to buy or sell. This helps to prevent unexpected losses and capitalize on profit.

b. How much am I willing to spend?

Depending on your risk appetite and tolerance, the amount of money you’re willing to risk fluctuates. It can be expressed as a percentage or as a monetary figure. Some are willing to risk 1% of their overall account, while others are willing to risk up to 3%. However, it is not advisable to risk losing more than 2% to 5% on a single trade.

c. How much do I want to make?

Making a profit goal is very important because this will help a trader from entering unnecessary trades.

2. Ignoring the Events, News, and the Economic Calendar: An economic calendar is a crucial tool for you as a trader. It displays the scheduled economic and financial market news events. Several of these occurrences have a significant impact on market volatility. Interest rate decisions, employment rates, and non-farm payroll data, for example, all have an impact on the economy. Furthermore, other occurrences may have a moderate to minor impact.

3. Emotional traders tend to invest higher sums to compensate for a loss which increases their risk. Forex traders must be sensible or they will not be able to achieve their profit goals.

Traders should get out of the market as soon as they recognize they’ve made a mistake, accepting the minimum feasible loss. This is because, once they are out, they will be patient and wait for a true opportunity to re-enter the market.

4. Taking Risk Management For Granted

Risk management is critical for traders who want to limit their risk of losing money. Many forex traders lose money not just because of a lack of market expertise, but also because of poor risk management. Controlling your emotions, having a plan, as well as taking profits and preventing losses, can all assist to lower your risk. Furthermore, by diversifying your forex portfolio and not putting all of your eggs in one basket, you can get a realistic profit by understanding the link between forex pairs and sectors.

To sum it up, It is critical to have a proper, strategic, planned, and solid trading base. Having the mindset of a successful trader might also be beneficial. Investing the time to learn the dos and don’ts of forex trading will pay you in the long run. Even expert investors will make mistakes and learn from them at some point. Keep in mind that the payoff is well worth the effort.