Risks match the glaring advantages that CFD trading has. The types of risks can be classified as market risk, counterparty risk, client money risk, and liquidity risk that are frequently ignored.

Market Risk

Fluctuations in the market conditions, newly placed policies from the government, and random and sudden information coming out from the news may skew the trade’s trajectory at a moment’s notice. Infinite changes may lead to a massive impact on the profits of traders. A second margin payment may be demanded by the broker if an inauspicious event transpires to the value of the underlying asset. If things have not been settled with the broker and trader, the broker has the option to close the trader’s position or worse, the trader has to sell the asset at a loss.

Counterparty Risk

The asset that will be used in a financial transaction will be provided by a company known as the counterparty. Remember that CFD brokers only provide contracts. If the counterparty fails to uphold their end of the bargain, namely the product/asset, the trader will now be doomed. A disclaimer that the CFD industry is highly unregulated and brokers get around through their reputation, financial position, and longevity. These are quite the shaky background. CFD trading is banned for American customers according to the U.S. regulations set by the law.

Client Money Risk

In some countries where CFD trading is approved, the government passed laws to protect the client’s money in case potentially rogue CFD brokers plan to cause financial havoc. CFD providers’ hedging can be prevented by classifying the money accordingly in accordance with the law when money is transferred to them. Pooled accounts are the culprit here. In countries where CFD trading is allowed, pooling is not regulated. This allows brokers to compensate for lacking accounts with the money provided by the prior client to meet margin calls, ergo affecting the initial trader’s profit.

Liquidity Risks and Gapping

Financial trades are getting affected by random market conditions. The risk of losses considerably augment as a result. A trader’s contract may become illiquid if the trade quota per underlying asset is not met. The worst case scenario: additional margin payments are something a CFD broker may require or if the prices go down, he may close the contract.

Less than optimal profits or financial mistakes the CFD provider will be shouldered by the trader who holds the contract. CFD assets may fall during a trade with a pre-planned trading price because of the natural pacing of the financial markets causing chaos.

Bottom Line

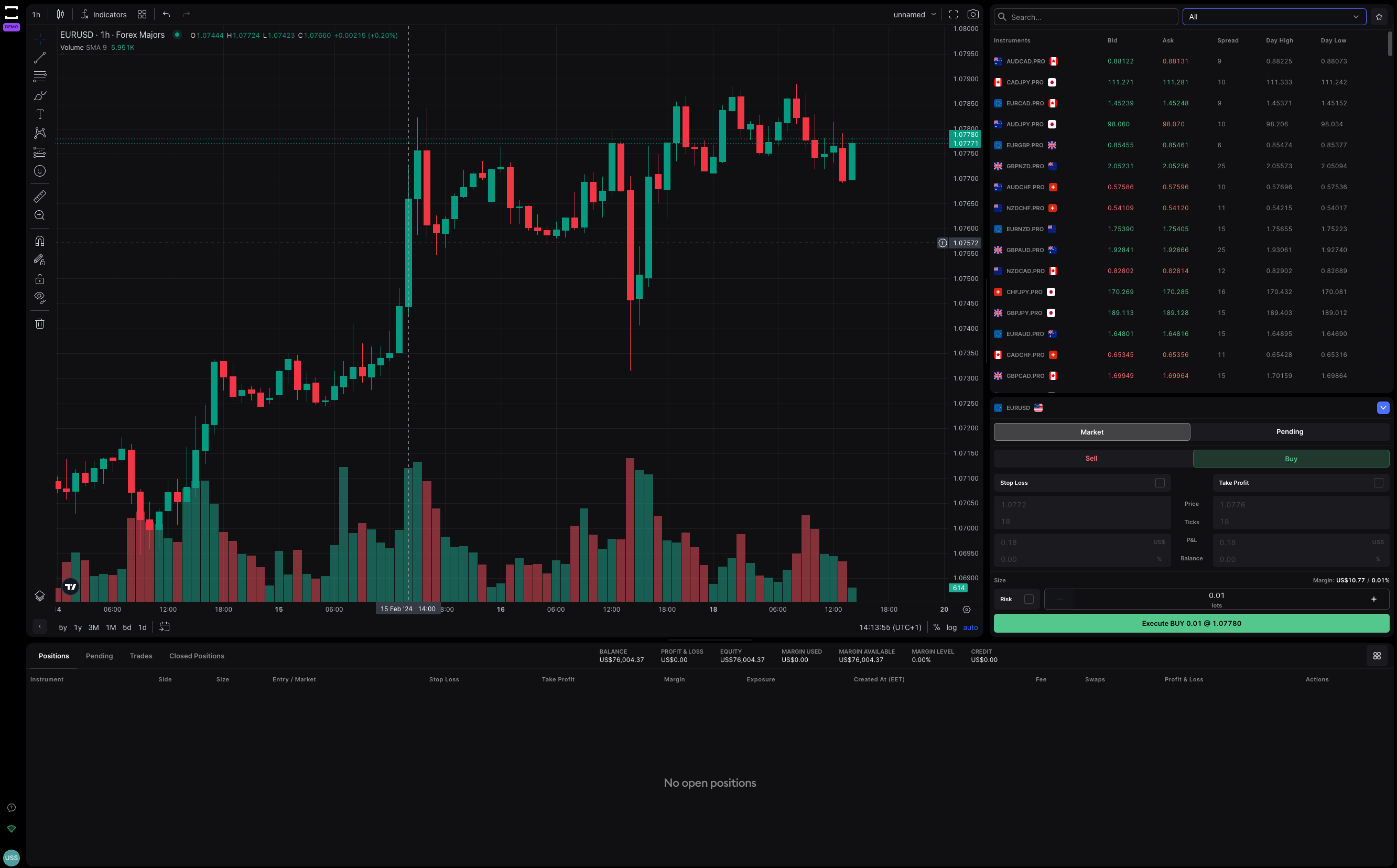

The best line of defense against all of this is a Stop-Loss Order. This may not prevent all of the risks, but will mitigate them as much as possible.