The banking and financial applications market is becoming increasingly competitive. Users are also getting more demanding, knowing exactly what they want from the product. In order to promote fintech products, marketers must take unconventional tactics.

Our world is improving and evolving as a result of innovative technologies. Choosing the best strategy and identifying your target market. As well as incorporating cutting-edge technologies and functionality into applications, today’s banking environment offers a considerable competitive advantage.

- Solutions for Big Data

Big data analytics and data science solutions assist clients in receiving personalized services. It detects and predicts fraud.

- Solutions for Financial Management

Experts are already developing methods to help people manage their finances. They continue to work with any financial information. Each of these solutions is simple to implement and saves time and money.

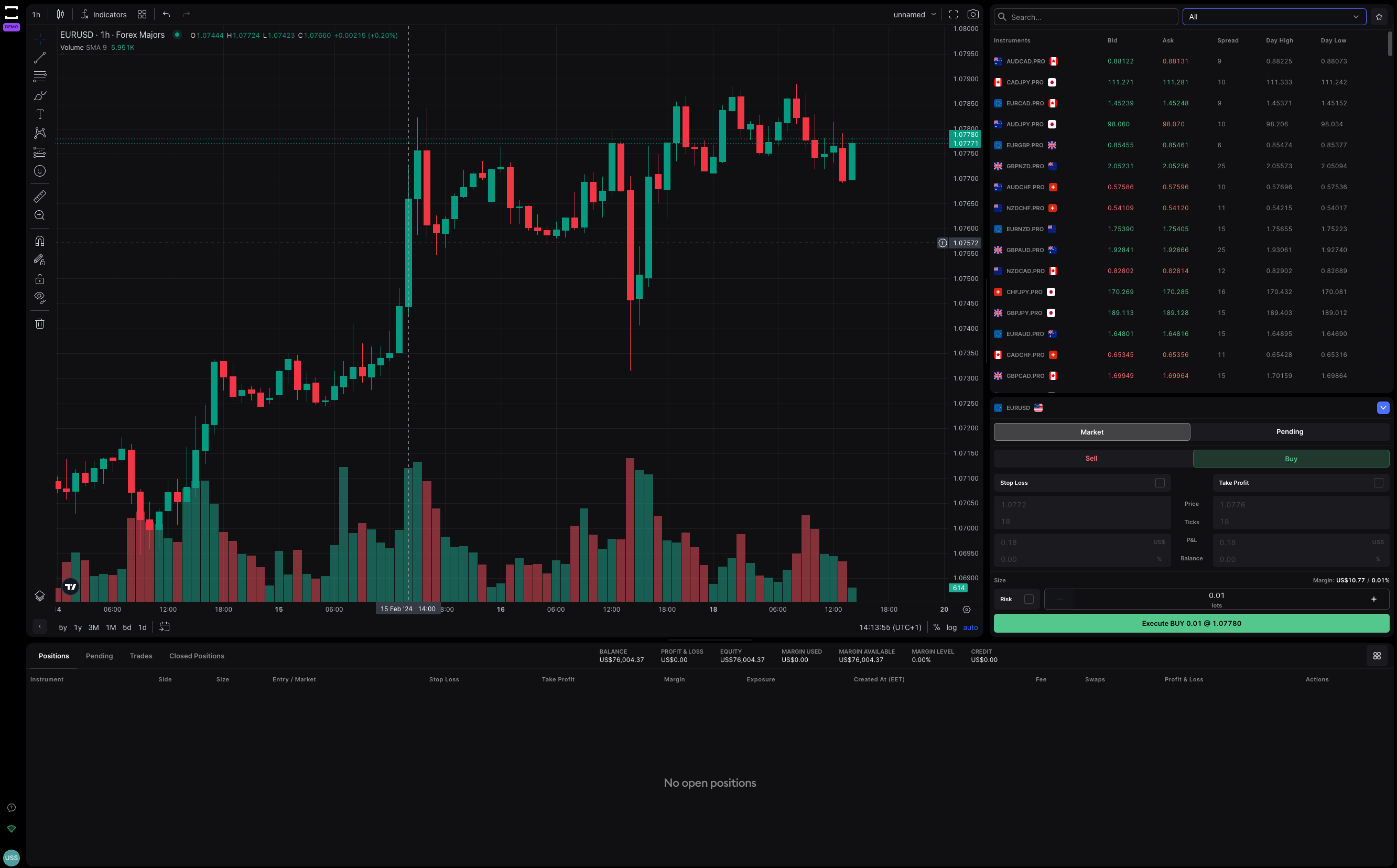

- Platforms for Electronic Trading

Innovative e-commerce systems with a well-thought-out framework have been developed. They enable clients to work longer hours. It is simple to interact with complex systems using technology and financial skills. Trading platforms are examples of such systems.

- Cryptocurrencies and Blockchain

The security of blockchain and crypto technologies for banking software development is very good. They also have anonymity. They also adhere to other python software development industry norms.

- Payment Alternatives

Banking software development services of numerous types have been established, including B2B and P2P transactions. They’re for mobile and digital payments. Retail and e-commerce industries can benefit from the solutions.

- The Best Financial Software Programs

Of course, there are numerous prominent financial programs that are used all around the world. Quicken, Mint, Mvelopes, Turbotax, https://maxoptions.net, and a slew of others should be mentioned. Each has its own set of benefits and drawbacks, but they all aid in the completion of important tasks.

- Challenges in the Development of Financial Applications

Software developers are not promoted in the same way that utilities are. This is owing to the product’s unique characteristics. The communication strategy should be linked to the brand and should communicate the product’s benefits. They are applicable to both the new and old applications. Prepare for the following while promoting the bank’s mobile application: user acquisition costs are considerable; a longer period of time before the desired action is carried out; the difficulty of implementing analytics and following the user’s path.

Banks and financial goods can assess user behavior thanks to smart functionality. Through digital banking fintech, they give customized solutions. It is up to us to figure out how to take advantage of these changes and use them to manage or grow our businesses.